A loan lending mobile app enables you to obtain money from any bank within a specific country at an interest rate produced by them. Loan lending applications allow you to compare the interest rates and recognize that one satisfies you best. Which one can lend you the amount for a specific time can be contacted.

Create a loan app is the top solution that can offer a straightforward solution for the loan selection within a time. With the appearance of smart technology and mobile apps, that entire loan lending method from the app through disbursement has become paperless, and fast for today’s high-tech generation.

Digital Loan Lending Market Size

The global digital loan lending platform market size was estimated at $5.58 billion in 2019 and the projected to reach $20.31 billion by 2027, growing near a CAGR of 16.7% from 2020-2027.

Digital lending is a great process to offer loans that are applied for disbursed and managed by a digital platform. The digital lending process starts with a loan app development including user registration with every detail, documentation submission through an online app, customer authentication and verification, loan approval confirmation, loan disbursement, and recovery.

This platform is increasingly selected among banks, which offers seamless efficiency, monitoring, and enhanced profitability benefits. Besides all, it allows borrowers to easily implement loans and offers them transparency which in turn leads to significant period profits.

How Does Loan Lending Mobile Apps Work?

The loan lending apps are a useful, simple, and progressive process of entire working. With a simple registration of a new use convert your payment into a loan. A user can link their bank account with secure and safe.

How is Loan Lending Mobile App Assisting in Financial Needs?

With the help of Loan lending apps where people don’t need to borrow money from their family or friends or other connection, as the app has their own backup plan for every customer.

People are totally open to taking loans from any bank after verifying themselves in their country at their given interest rate. This is the instant process to get the loan as per their need.

Simply download the app from Play store and app store and get the verification to participant.

A Loan Lending Mobile Apps Prove to Be Most Useful

- Startup incubators

- Startup Funding

- Financial/Economic Institutions

- Investment Brokers

- Investment & Stock firms

- Angel Investors

- Venture Funds

- Consulting Business

- Service Provider

Key Feature Of Loan Lending Mobile App

When your idea turns into developing a highly responsive and revenue-generating money lending app that needs the administration of a lot of features that can be integrated with the app.

Loan lending mobile app development offers a starting to end point solution where a customer can give an easy process.

Here are the standard and advanced features that can be included in the loan lending app, and you are open to choose the kinds of as per your idea and requirements.

User App Features

- Registration

- New users can register by entering their personal information and getting themselves registered.

- Simple Browsing

- An easy method of browsing permits lenders to perform through all loan apps and obtain the perfect borrower for lending their money.

- Borrower Profile

- A simple option to manage the borrower profile info like Name, Location including they can generate a fresh loan mobile application.

- Advanced Search

- Using a specific amount, keyword, and the lender can search out for Loan Investment Proposals (LIP).

- Loan Proposal List

- Lenders can view the list by various factors such as loan purpose, amount to borrow, and loan duration.

- Safe & Secure

- Proper information regarding the borrower in the kind of records is provided so a lender can determine whether it’s safe or not.

- Apply for Loan

- The user can apply for an instant loan where they are able to choose the required amount. As EMI, GST needs to be paid, and the processing charge to finish the fund transfer.

- Calculation Tool

- The inbuilt feature in the application that allows the user to calculate and view the EMI and Interest amount which will be paying.

- Transactions

- It will show the full history of the money borrowed that amount of Withdrawal and an available credit deadline.

- Messages

- Lenders and borrowers are able to send and receive messages in the chat box above their personal requirements regarding the loan process.

- Application Management

- The Borrower has a choice to check the several loan applications and real-time track the application status online.

- Period Setting

- The user can choose a specific payback period and pay the EMI according to their plan and can see the interest in the application.

Admin Panel Features

- Dashboards

- A dashboard will allow you to be well-informed about ongoing activities in the loan lending mobile app via the dashboards. An admin can see such as total landed, partners, total users, total earnings and that can be filtered based on data and date field.

- Profile Approval

- Admin can verify and check those profiles and data entered by the user.

- Repayment

- That allows the users to repay the system where the user can give access to return the amount.

- Reporting & Analytics

- Real-time reporting does an important aspect of the sort of applications that helps to build data toward the informational reports, it helps while monitoring, analyzing, data, extract, actionable and significant data that can be helpful to increase app performance.

- Managing User

- An admin can manage the users. They can add, edit, delete and block the user account.

- Security

- This is an important feature of the system that attracts a number of users app dealing and original data of the users. You must ensure app security, certified devices should be integrated into the system.

- Manage Earning

- The admin does effectively view and manage the complete earning of the users, income, and any sort of pending amount if they have.

- Cloud Storage Integration

- That is helpful for the system to collect user’s data that takes care of security and privacy.

- CMS integration

- CMS integration manages the content and total pages which are displayed in the app, which can be editable such as Terms & condition, policy, and both in the Image form as well as text.

- Online Support

- The most important integral which is greatly beneficial for the customers where the users can query to help from the system whenever required.

- Bank Partner Management

- Within the system runs the bank partners so the banks can collaborate and can be managed from here.

What Team Structure Will be helpful to Create a Loan Lending Mobile App?

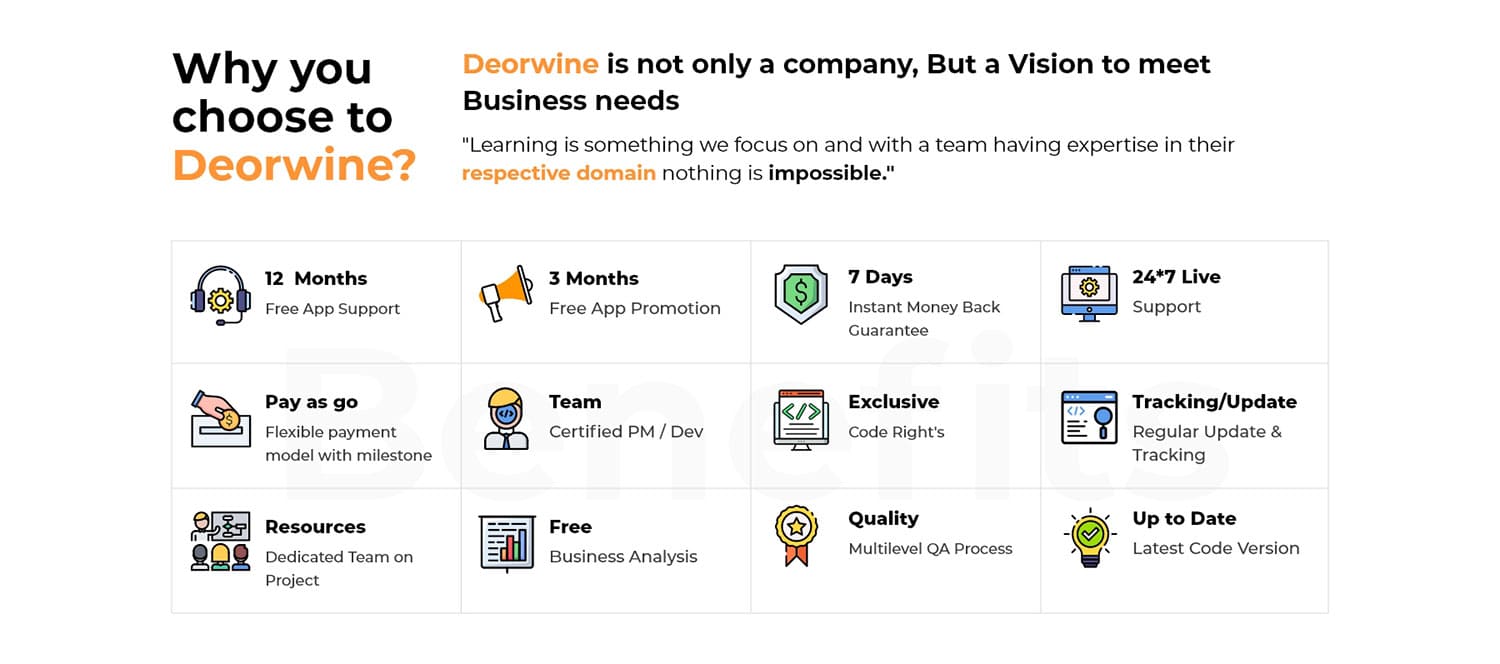

Loan app developers must understand your project and estimate the cost is going to depend highly on approaching the team you hire, in case of skills and time-frame. If you want to develop an app with Deorwine’s possible team and require to hire a Loan Lending Mobile App Development Company. The whole team you need:

- Business Analyst

- UX/UI Designer

- App Developer

- QA Specialist

- Support & Maintenance

How Much Does It Cost To Create a Load Lending Mobile App?

The cost to develop a loan lending mobile app remains defined through various factors that can affect the cost and time frame. Your mobile app considers standard and advanced features and must support kinds of loan lending activities, and the cost of an app will be comparatively higher than a basic app with functionality.

Do you have an Idea?

Conclusion

With the latest technology which is the mind-wrecking method of loan management that has become more apparent now. When you are planning to develop a Loan Lending app where you will require skilled mobile app developers, designers, project managers, and a complete-time to deliver them successfully.

Now it’s time to get in touch with the best mobile app development company to fill the missing or require spark for your business target by getting a loan lending app developed in the marketplace.

In the current time, you can enhance the app by having a statement with the development team before a significant initiation of the project to streamline the workflow as per your idea and business requirements.

Are You Looking For Best Loan Lending Mobile App Development Company

We are an expert mobile app development company that has 8+ years of experience in the IT field. Deorwine has a rich-service to offer their clients according to the market trends which has always provided the end-to-end solution for every domain.